After nearly a decade of unprecedented monetary easing, Japan is navigating a crucial turning point with the Bank of Japan (BOJ) ending the era of negative interest rates.

We release well researched reports on Global markets-Outlook and Strategies, 15 currencies, 9 Commodities, Risk management and Hedging strategies, Hedging instruments and Best practices. Subscribe and Log on to QuantArt Hedgenius to access our full Exclusive Reports.

The 2024 outlook for zinc indicates a modest increase in global demand, projected at 2.5% growth to reach 13.9 million tons. Key sectors driving this demand include construction, automobiles, and consumer goods, with significant growth expected in markets like the U.S., India, Japan, China and European countries like Italy, Norway and Poland. The China Manufacturing PMI reading for March 2024 came in strongest in the past 12 months, raising hopes of a Chinese demand recovery and fueling downstream zinc purchases and Chinese export orders. Moreover, the temporary halting of operations at Glencore’s McArthur River zinc mine could potentially tighten mine supply. Renewed buying momentum and possibility of supply tightening indicates a bullish to stable outlook for zinc prices in the short term. The global supply of refined zinc is also set to rise by 3.9%, potentially leading to a surplus, which could stabilize prices in the medium term.

The CAD Outlook indicates a potential Bank of Canada rate cut in June due to lower-than-expected inflation. The economy outperformed forecasts with 1% growth, driven by exports despite weak domestic demand. Record immigration is complicating inflation control, impacting housing and unemployment. The housing market is cooling, with home sales and prices dropping. Unemployment rose slightly, reflecting slow job growth amidst high immigration. Trade surplus improved in January, and rising oil prices due to geopolitical tensions and OPEC+ cuts are benefiting Canada’s trade balance. The economy faces challenges with slow growth and high unemployment, but potential rate cuts may support the economy. The currency’s performance is expected to be stable short-term, with a possible depreciation in the medium term.

The “USDINR Outlook and Strategy” report of February 2024 dissects the intricate interplay between rate expectations and currency performance. It offers a deep dive into the hedging strategies essential for navigating the currency markets. The analysis details the impact of US monetary policy on the Indian Rupee and outlines potential paths for USDINR, considering various global and domestic economic scenarios.

The AUD Report highlights a mixed economic landscape for Australia. Inflation has reduced to 4.1% from 5.4%, driven by lower goods and services inflation, though remaining above the target range. The economy grew by 1.5% in Q4 2023, with manufacturing and service sectors showing varied performances. A significant current account surplus was recorded, driven by a rise in trade surplus. However, retail sales have slowed, and the retail sector faces challenges, despite a drop in unemployment to 3.7% and a surge in wage growth to 4.2%. The report suggests cautious optimism, with expectations of steady borrowing costs amidst challenges like a slowing housing market and retail sector.

The Egyptian economy grapples with significant challenges, including a devalued currency, rising debt concerns, and socio-economic stresses like poverty and unemployment. Inflation surged to 35.7% in February 2024, prompting the central bank to hike the key interest rate by 600 basis points to 27.25%. Despite these challenges, Egypt attracts global investment with high bond yields, bolstered by an $8 billion IMF loan and substantial international aid. The economy shows resilience in sectors like tourism and the Suez Canal, offering hope amidst adversity. The EGP’s outlook suggests stability, with expectations to move within the range of 46-49, indicating cautious optimism for Egypt’s financial future.

Japan’s economy showed modest expansion in Q4 2023 amidst challenges like an aging population, manufacturing decline, and economic stagnation. Inflation easing to 2.2% in January 2024 suggests potential shifts in monetary policy. Trade deficit narrowed, indicating positive trade dynamics, while domestic indicators like unemployment and retail sales show stability. However, challenges in government spending and housing persist, with the yen’s outlook remaining uncertain amid global economic conditions. The outlook for Japan’s economy includes cautious optimism with modest growth and stable inflation, yet faces potential shifts in monetary policy amidst global uncertainties. The yen’s future is poised between weakening trends due to dovish global policies and potential appreciation in times of global tension or crises, highlighting its sensitivity to international economic dynamics.

✔ All You Need Is In One Place

✔ Live Spot and Forward Premium

✔ Hedge MIS

✔ Hedge Strategies with Scenario Analysis

✔ Option Calculator

✔ Knowledge Hub

✔ Impeccable track record

✔ Advisory by industry experts with 25+ years experience

✔ Focus on meeting objectives

✔ Advisory aligned with clients vision

✔ Regular review

✔ Advisory on Fx, Interest Rates, Commodities

✔ 750+ Trained participants, from 100 corporates and banks

✔ Exemplary Faculty

✔ Fine Balance of Practical and Pedagogy

✔ World class content and customized modules

✔ Excellent Feedback

✔ Option of Offline and Online training sessions

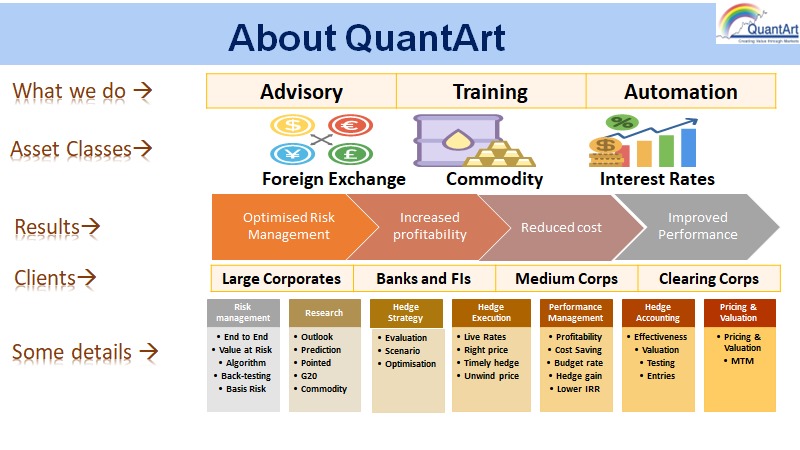

QuantArt is committed to unlock the hidden values for our clients by optimizing risk and return. The Optimisation is done across asset classes such as Foreign Exchange, Interest Rate, Commodities, Bond, DCM, ECM, and Credit. We work across geographies with nuances of local markets while firmly tracking the Global Financial Market. Our vision is to continuously bridge the global financial market asymmetries through our domain knowledge, intelligence, insights, tools, software and technology and analysis and bring about assured risk-adjusted savings through optimization for corporates and institutions.

Managing treasury operations can be a complex and a time-consuming task that requires a high level of expertise and attention to detail. This is why we have built “Hedgenius.” This is a Global Software, designed and built by Treasury experts with over 25 years of experience in Treasury Management for corporate treasuries.

Managing Director

Samir Lodha founded QuantArt in 2012 January which has been running for the last 10 years. He is an MBA from the Indian Institute of Management Calcutta (IIMC) and has around 20 years of experience in Forex and Interest rate risk management. Prior to that, he had worked in senior positions with foreign exchange treasuries of JP Morgan (Executive Director), HSBC (Associate Director), and ICICI Bank wherein he advised large companies across India on risk management and hedging of foreign exchange and interest rates exposures. He has significant experience in Fx and rate markets along with a sound experience and understanding of global markets, market economics, hedging strategies, hedge algorithms, price calculation, and risk-return optimization.

Managing Partner

Srinivas Puni is an MBA from the Indian Institute of Management Bangalore (IIMB) with over 15 years of experience in structuring forex and interest rates derivatives. He has worked with banks like JP Morgan, Standard Chartered, Yes Bank, and Axis Bank in the past. He conducts training on foreign exchange and risk management as well as advises specifically large clients. Srinivas has an in-depth understanding of the quantitative models behind derivative valuation and related CVA, DVA, FVA modeling. He specifically handles pricing, valuations, structuring, risk modeling etc

Managing Partner

Vinod is an MBA from IIM Lucknow with 20+ years of experience in treasuries in India and Hong Kong wherein he advised large companies and banks on risk management, markets, and hedging. Prior to joining QuantArt, he held the positions of Executive Director in Goldman Sachs and BNP Paribas. Vinod has extensive skills in simplifying complex situations and convert the same into a hedge opportunity.

Managing Partner

Sandip is a post graduate from BITS Pilani with 25+ years of experience in global markets. He began his banking career with SBI and thereafter held leadership position at treasury at American Express Bank, Deutsche Bank and ICICI Bank in India. He was an investment banker for 7 years covering areas including PE intermediation, debt syndication and FX advisory. Sandip was Chief Treasury for Tata Steel Group between 2014-2020, where he led a large team with distinction in hedging currency, interest rates and commodity, investment of surplus funds, retirals investment, working capital management, RBI regulations etc.

Managing Director

Managing Partner

Managing Partner

Managing Partner

Samir Lodha founded QuantArt in 2012 January which has been running for the last 10 years. He is an MBA from the Indian Institute of Management Calcutta (IIMC) and has around 20 years of experience in Forex and Interest rate risk management. Prior to that, he had worked in senior positions with foreign exchange treasuries of JP Morgan (Executive Director), HSBC (Associate Director), and ICICI Bank wherein he advised large companies across India on risk management and hedging of foreign exchange and interest rates exposures. He has significant experience in Fx and rate markets along with a sound experience and understanding of global markets, market economics, hedging strategies, hedge algorithms, price calculation, and risk-return optimization.

Srinivas Puni is an MBA from the Indian Institute of Management Bangalore (IIMB) with over 15 years of experience in structuring forex and interest rates derivatives. He has worked with banks like JP Morgan, Standard Chartered, Yes Bank, and Axis Bank in the past. He conducts training on foreign exchange and risk management as well as advises specifically large clients. Srinivas has an in-depth understanding of the quantitative models behind derivative valuation and related CVA, DVA, FVA modeling. He specifically handles pricing, valuations, structuring, risk modeling etc

Vinod is an MBA from IIM Lucknow with 20+ years of experience in treasuries in India and Hong Kong wherein he advised large companies and banks on risk management, markets, and hedging. Prior to joining QuantArt, he held the positions of Executive Director in Goldman Sachs and BNP Paribas. Vinod has extensive skills in simplifying complex situations and convert the same into a hedge opportunity.

Sandip is a post graduate from BITS Pilani with 25+ years of experience in global markets. He began his banking career with SBI and thereafter held leadership position at treasury at American Express Bank, Deutsche Bank and ICICI Bank in India. He was an investment banker for 7 years covering areas including PE intermediation, debt syndication and FX advisory. Sandip was Chief Treasury for Tata Steel Group between 2014-2020, where he led a large team with distinction in hedging currency, interest rates and commodity, investment of surplus funds, retirals investment, working capital management,RBI regulations etc.

Understanding Factors Driving Global Currency Outlook. Build your Hedge & Risk Management Strategy using Hedgenius

Build your Commodity Outlook, Hedge & Risk Management Strategy for 2024 using Hedgenius

Build your Interest Rate Outlook, Hedge & Risk Management Strategy for 2024 using Hedgenius

Build your Import & Export Hedging plan using Forwards and Options using Hedgenius

How to do save money for your organisation while doing FX Rate Negotiation using Hedgenius

How to use Hedgenius for Pricing Option Structures and get costs

Our Events are spread across the year. Our focus is to have workshops and knowledge sessions that increase the effectiveness both of an individual and an organization. The sessions are structured on practical relevant operations aspects. We also have sessions on updated, current, relevant market movements and practices, regulations, knowledge, and technology. All training/knowledge sessions are complimentary for our advisory retainer clients and Hedgenius subscribers. Explore what we have for you.

At QuantArt Market Solutions Pvt. Ltd., we prioritize your privacy and aim to provide you with the best browsing experience on our website. By clicking 'Accept,' you are consenting to our use of cookies in line with our Privacy Policy. Your agreement acknowledges and complies with our approach to managing data and ensuring your confidentiality.

At QuantArt Market Solutions Pvt. Ltd., we prioritize your privacy and aim to provide you with the best browsing experience on our website. By clicking 'Accept,' you are consenting to our use of cookies in line with our Privacy Policy. Your agreement acknowledges and complies with our approach to managing data and ensuring your confidentiality.