USDTRY Outlook and Strategy

Published on - 15th March 2024

Navigating The USDTRY Landscape: Key Insights

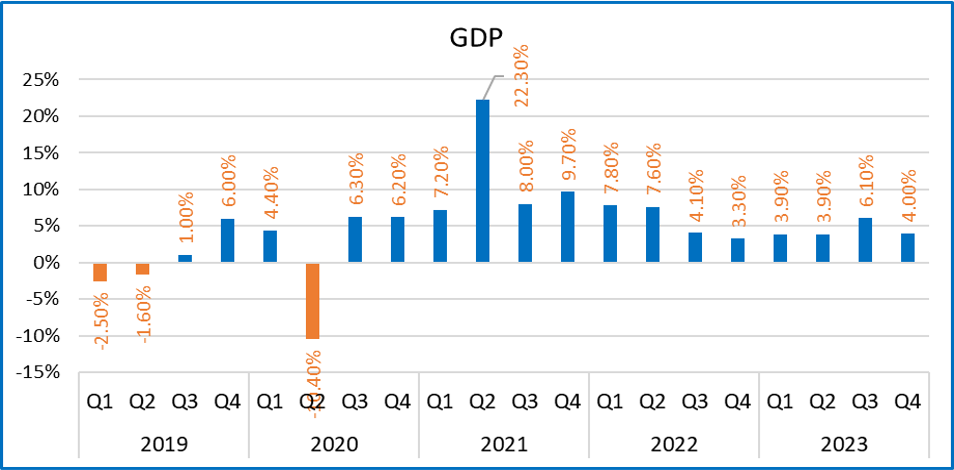

Strain on Economy growth – Turkey experienced a slight slowdown in economic growth, with 2023 growth reaching 4.5%, down from 5.5% in 2022. Household spending and investment were key drivers of growth in the fourth quarter, leading to a 1% increase in GDP in Q4 2023. However, consumer spending resilience poses challenges to reducing inflation, which remains a concern for policymakers.

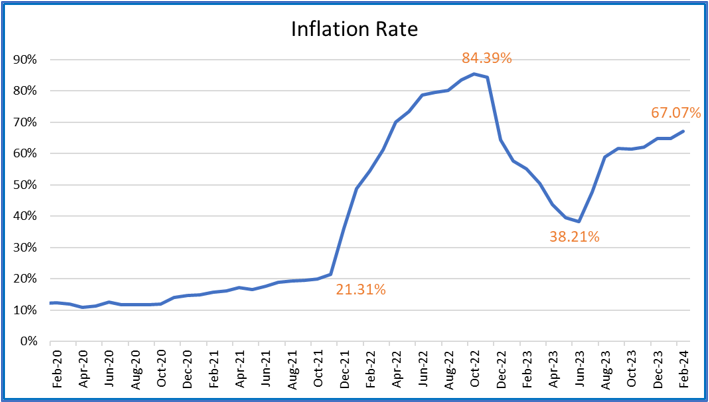

Monetary Policy and Inflation – The Central Bank of Turkey implemented a shift towards tighter monetary policy to combat inflation, which reached a 15-month high of 67.1% in February 2023. Despite maintaining interest rates at 45%, deeply negative real interest rates persist. Inflationary pressures stem from wage and tax increases, as well as persistent domestic demand. The expectation is for inflation to peak at over 70% in May before gradually decreasing.

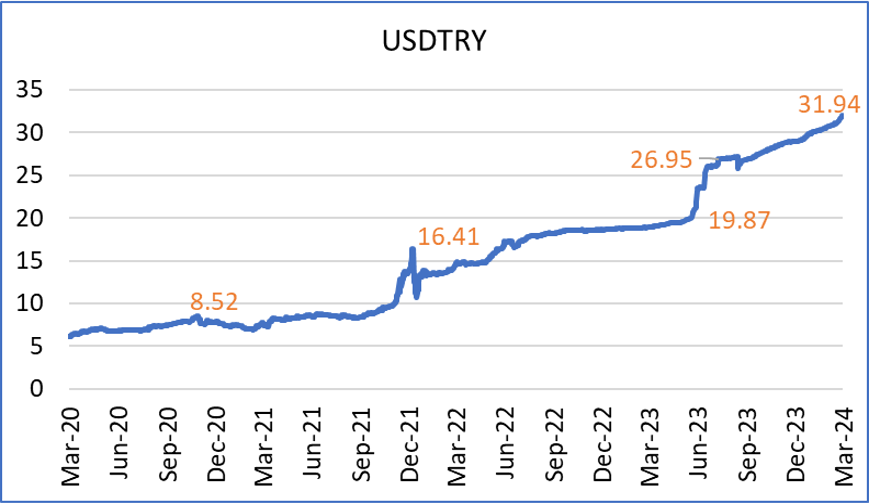

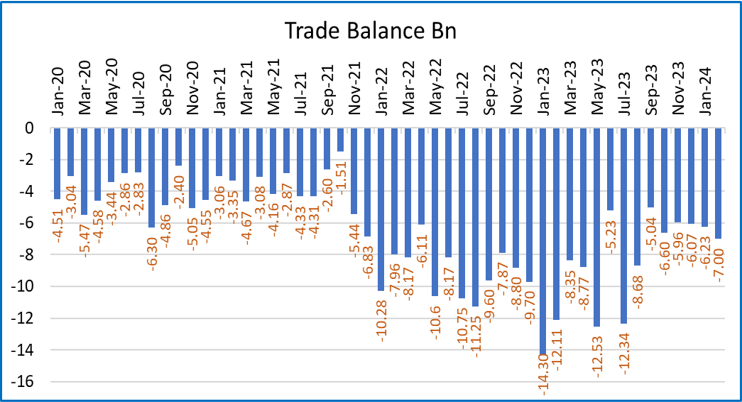

Current Account Deficit and Exchange Rate Policy – Turkey’s current account deficit showed improvement in 2023, shrinking to $45.2B from $49.1B in the previous year. However, the trade deficit increased in February 2024. Foreign exchange reserves have decreased since December 2023 due to interventions aimed at protecting the Turkish lira from depreciation. The government modified regulations to discourage foreign currency savings and promote local currency usage, including raising costs for holding hard currency deposits.

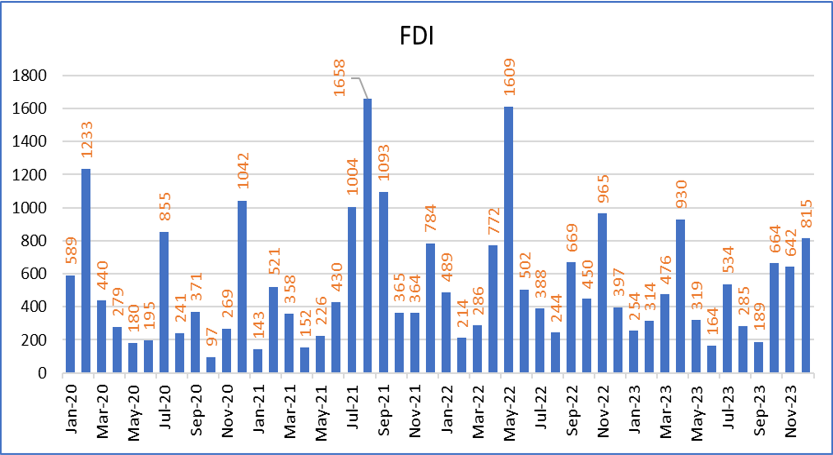

Foreign Direct Investment and Policy Shifts – Turkey aims to attract foreign direct investment through policy shifts, such as debating a data law bill to enhance FDI potential. Expectations suggest a potential influx of $18.6B in FDI, particularly benefiting sectors like telecom, IT, retail, and aviation. Strategic ties with the Gulf region have also enhanced investment activities. Recent policy normalization measures have made Turkey more attractive to foreign investors, potentially supporting the lira in the medium term.

Exchange Rate Outlook and Economic Uncertainty – The Turkish lira has faced pressure due to high inflation, external debt risks, and global economic uncertainty. Despite positive steps towards normalization, such as improving forex reserves and aligning domestic lending rates, short-term challenges persist. Expectations suggest the USDTRY exchange rate may move towards 31-33 in the near term, with the potential for improvement towards 27.00 when global USD weakness occurs.